Author: leduyduc

-

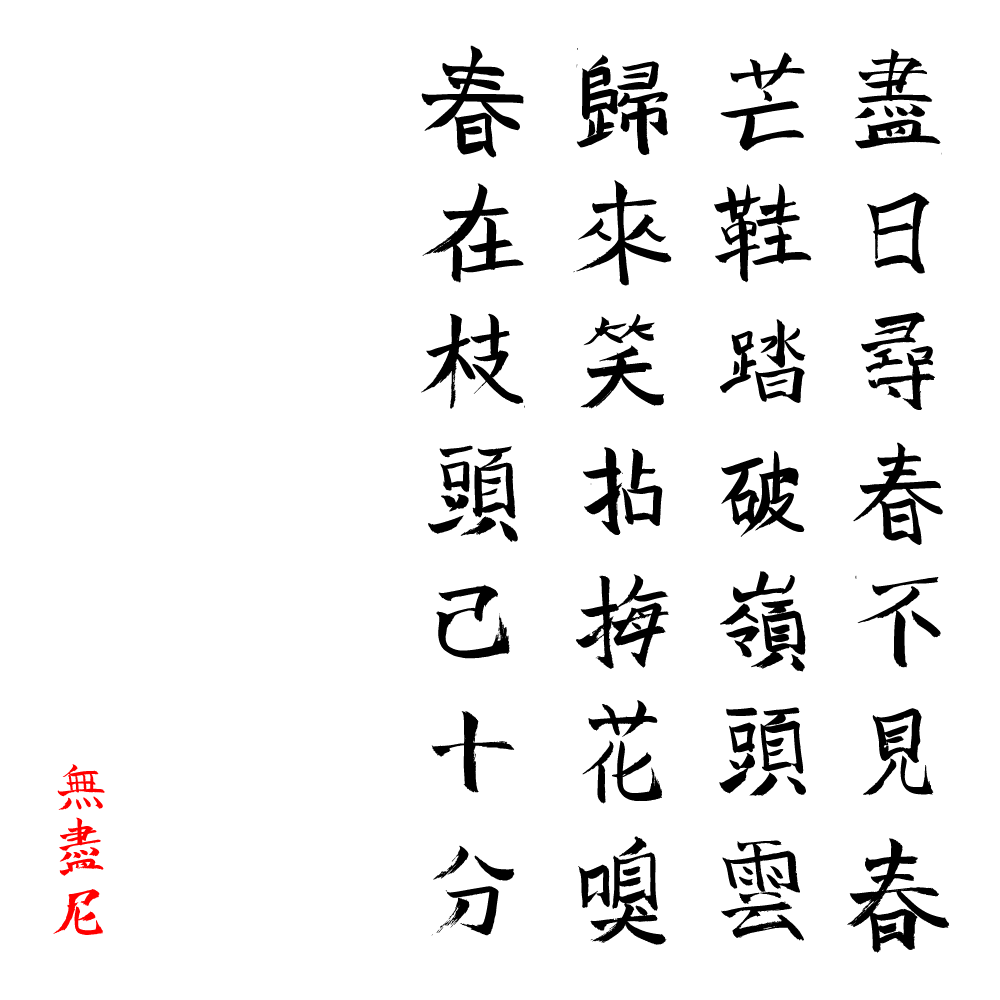

Ngộ đạo thi 悟道詩

Tận nhật tầm xuân bất kiến xuân

Mang hài đạp phá lĩnh đầu vân

Quy lai tiếu niêm mai hoa khứu

Xuân tại chi đầu dĩ thập phân

-Vô Tận Ni-Ngày ngày tìm xuân chẳng thấy xuân

Giày cỏ vượt núi tận mây xanh

Trở về nhặt nhành hoa cười tận

Xuân đó đã ở trọn trên cành

-Thiền Sư Ni Vô Tận Tạng-Endlessly finding spring without avail

Grass shoes trod across mountains and clouds

Coming back to laugh at the flower

Spring has fully blossomed at the branches

-Zen Master Wu Jin-

-

Cái ôm

Ngày tuyệt đẹp

Mưa mát cùng

Trái tim

Nhảy múa

Ngọt ngào

Có xíu lạc nhịp

Luống cuống

Thế nhưng trong sâu thẳm

Con tim rõ ràng

Yêu

Say khướt

Lâng lâng